Real Estate Funds

US Real Estate Funds

- NRIA Partners Portfolio Fund – Focused East Coast (New Jersey, Philadelphia, Florida) Real Estate Fund.

- Structured Equity Investment with a targeted return of 14 to 21% per annum.

Why invest in US Real Estate?

- Strong Economy

- Stability

- Safe Investment for Global Investors

- High Demand for Multi-Family Housing & Low Investment Risk

- Returns

Key Funds Terms

- FUND SIZE (TOTAL CAPITAL COMMITMENT TARGET) Amount equal to Capital Commitment

- MINIMUM CAPITAL COMMITMENT $15,000 ~INR 11 Lacs*

- INVESTMENT PERIOD (Deployment) Immediately upon funding. Once a property is closed by NRIA, a detailed memorandum describing the investment / development, along with a copy of the title and deed of ownership and new NRIA Portfolio Fund collateral closed will be delivered to investment partners

- FEES NIL, ZERO Fees would be charged to fund. ZERO Carry / Sharing on delivery of promised returns

- REDEMPTION PERIOD 5 Years +1 Year

- LOCKED PERIOD 30 Months

- TARGET LOCATION New Jersey, South Florida – Palm / Delray Beach and Philadelphia

| INVESTMENT (USD) | INVESTMENT (INR LACS) (Exchange Rate 1 USD= 70 INR)* |

RETURNS PER ANNUM (USD) | CORPORATE ASSURANCE (USD) |

|---|---|---|---|

| 15,000 | 10.5 | 14% | 12% |

| 25,000 | 17.5 | 15% | 12% |

| 50,000 | 35.0 | 16% | 12% |

| 100,000 | 70.5 | 18% | 12% |

| 150,000 | 105.0 | 20% | 12% |

| 500,000 | 350.0 | 21% | 12% |

PAYOUT: Investors are paid 8%* per annum till 4th year and true up of return is done in 5th year. This ensures there is regular inflow for investors.

NOTE: The enhanced 8 % annualized monthly cash flow ach benefits herein WILL ONLY be paid to investors that fund their investment within thirty calendar (30) days of the date of the executed registration addendum. Funding after your registration date herein reverts your ach payment to the normal 6% funding level on investments.

| Returns for 14% pa product | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|

| Yearly Return | 8% | 8% | 8% | 8% | 14% |

| True Up of Return | 24% | ||||

| Yearly Return | 8% | 8% | 8% | 8% | 38% |

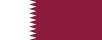

Antigua & Barbuda

Antigua & Barbuda